Portugal D2 Entrepreneur Visa: Complete 2025 Guide

The Portugal D2 Visa, commonly known as the Entrepreneur Visa or Business Visa, offers a pathway to Portuguese residency for entrepreneurs, independent professionals, and business owners looking to establish or relocate their business activities to Portugal. This visa category has gained significant popularity as Portugal positions itself as an emerging startup hub in Europe with a favorable business environment, competitive tax incentives, and an excellent quality of life.

This comprehensive guide covers everything you need to know about the Portugal D2 Visa in 2025, from eligibility requirements and application procedures to business considerations and pathways to permanent residency and citizenship.

Who Is the D2 Visa For?

The D2 Visa is designed for several categories of business-minded individuals:

- Entrepreneurs looking to establish a new business in Portugal

- Business owners seeking to expand existing operations to Portugal

- Self-employed professionals and freelancers providing services in Portugal

- Independent service providers working with Portuguese clients

- Startup founders (though there is also a dedicated Startup Visa program)

- Investors in existing Portuguese businesses (for smaller investments than Golden Visa thresholds)

Unlike investment-focused visas like the Golden Visa, the D2 focuses on active business participation rather than passive investment. The visa holder is expected to be actively involved in managing the business operations in Portugal.

Key Benefits of the D2 Visa

- Business flexibility: No minimum investment amount is legally specified

- Family inclusion: Spouse/partner and dependent children can be included

- Path to permanent residency: After five years of temporary residency

- Path to citizenship: Eligible to apply for Portuguese citizenship after five years

- Access to Portuguese healthcare: National health service after residency is established

- Schengen Area travel: Freedom to travel within the Schengen Area

- Tax benefits: Potential to apply for the Non-Habitual Resident (NHR) tax scheme

- Business-friendly environment: Access to Portugal’s growing startup ecosystem, EU market, and business incentives

Types of Businesses Qualifying for the D2 Visa

The D2 Visa is flexible in terms of the type of business activities it covers. Qualifying business activities include:

New Business Creation

Establishing a new company in Portugal, which may be:

- A traditional limited liability company (LDA)

- A sole proprietorship

- A branch of a foreign company

- A representative office

Acquisition of Existing Business

Purchasing and managing an existing Portuguese business.

Self-Employment

Operating as an independent professional providing services, such as:

- Consulting

- Freelance work

- Professional services (legal, accounting, creative, technical, etc.)

- Artisanal crafts or trades

Business Extension

Expanding an existing foreign business to Portugal through:

- Opening a Portuguese branch

- Establishing a subsidiary

- Creating a representative office

Business Plan Requirements

While there is no specified minimum investment amount for the D2 Visa, the business plan is a crucial component of the application. Portuguese authorities evaluate the business plan based on several criteria:

Economic Viability

The business should demonstrate potential for profitability and sustainability in the Portuguese market. This includes:

- Market analysis and opportunity assessment

- Financial projections (3-5 years)

- Break-even analysis

- Revenue streams and business model clarity

Social and Economic Relevance

The business should contribute positively to Portugal’s economy by:

- Creating employment opportunities for locals

- Addressing market needs or gaps

- Contributing to regional development

- Bringing innovation or expertise to the Portuguese market

Feasibility

The plan must be realistic and feasible, considering:

- The entrepreneur’s experience and qualifications

- Available resources and capital

- Practical implementation timeline

- Understanding of local market conditions and regulations

Financial Requirements

While the D2 Visa doesn’t specify a minimum investment amount, applicants must demonstrate:

Initial Capital

Sufficient initial capital to establish and operate the business for at least 12 months. The amount varies depending on the business type, but generally:

- Service-based businesses: €5,000-€15,000 minimum

- Retail or manufacturing: €15,000-€50,000+ minimum

- Tech startups: Depends on the business model, typically €20,000+

Personal Financial Means

Sufficient personal funds to support yourself and any family members during the initial business establishment period:

- Approximately €8,460 for the main applicant (equivalent to 12 months of Portuguese minimum wage in 2025)

- Additional funds for accompanying family members

Required Documents

The D2 visa application requires extensive documentation, including:

Personal Documents

- Valid passport with at least 6 months validity beyond intended stay

- Completed visa application form

- Recent passport-sized color photographs

- Proof of legal residence in your current country (if not a citizen)

- Criminal record certificate from your country of residence for the past 5 years

- Travel insurance valid for at least 4 months with coverage of at least €30,000

- Authorization form for criminal record check in Portugal

Business Documentation

- Comprehensive business plan (in Portuguese or with certified translation)

- Proof of financial means to invest in and sustain the business

- Company registration documents (if expanding an existing business)

- Proof of qualifications, experience, or skills relevant to the business

- Portuguese company incorporation documents (if already established)

- Proof of business premises in Portugal (lease agreement, purchase deed, etc.)

Financial Documentation

- Bank statements showing sufficient funds for investment and personal support

- Portuguese NIF (tax identification number)

- Proof of accommodation in Portugal (rental agreement, property deed, etc.)

Additional Documents for Family Members

- Marriage certificate for spouse (apostilled)

- Birth certificates for children (apostilled)

- Proof of financial dependency for dependent children over 18

All non-Portuguese documents must be translated by a certified translator and apostilled or legalized.

Business Setup in Portugal

Legal Business Structures

The most common business structures in Portugal include:

- Sociedade por Quotas (LDA) – Limited Liability Company

- Minimum capital: €1 (previously €5,000)

- Requires at least one shareholder

- Limited liability for shareholders

- Most common choice for small to medium businesses

- Sociedade Unipessoal por Quotas – Single-Member Limited Company

- Similar to LDA but with a single shareholder

- Good option for solo entrepreneurs

- Sociedade Anónima (SA) – Public Limited Company

- Minimum capital: €50,000

- Requires at least five shareholders

- More complex governance structure

- Suitable for larger operations

- Empresário em Nome Individual – Sole Trader

- No separate legal entity

- Unlimited personal liability

- Simpler accounting requirements

- Suitable for sole professionals

Registration Process

The process for establishing a company in Portugal typically involves:

- Obtain a Portuguese Tax Number (NIF)

- Required for both individuals and the company

- Non-residents need a fiscal representative

- Choose and Register Company Name

- Verify availability through the National Registry of Legal Entities (RNPC)

- Name reservation is valid for 3 months

- Draft Company Bylaws

- Define company structure, governance, and operations

- Usually prepared by a lawyer

- Open Corporate Bank Account

- Deposit initial share capital

- Requires company documentation and shareholder identification

- Execute Company Incorporation Deed

- Can be done through a notary, Empresa na Hora (company in an hour) service, or online platform

- Register with Commercial Registry

- Obtain commercial registration certificate

- Publish incorporation in the official gazette

- Register with Tax Authorities

- Obtain company tax identification number

- Register for VAT if applicable

- Register with Social Security

- Required within 10 days of starting activity

- Needed for hiring employees

- Obtain Business License

- Specific requirements depend on business activity

- Some activities require special permits or licenses

Application Process: Step by Step

Step 1: Business Preparation

Before applying for the D2 visa:

- Develop a comprehensive business plan

- Research Portuguese market and regulations

- Identify business location and premises

- Secure initial funding

- Establish professional connections in Portugal (recommended)

Step 2: Initial Setup

- Obtain a Portuguese NIF (Tax Identification Number)

- Non-residents must appoint a fiscal representative

- Several services now offer remote NIF application assistance

- Open a Portuguese Bank Account

- Personal account initially

- Corporate account after company formation

- Several Portuguese banks accept non-resident applications

- Begin Company Formation Process (Optional)

- Can be done before or after visa approval

- Starting the process demonstrates commitment to Portuguese authorities

Step 3: Gather Required Documents

Compile all the documents listed in the “Required Documents” section above, ensuring all non-Portuguese documents are properly translated and apostilled.

Step 4: Submit Visa Application

- Schedule an appointment at the Portuguese consulate in your country of residence

- Submit your application with all supporting documents

- Pay the application fee (approximately €90)

- Attend an interview at the consulate if required

Step 5: Receive 4-Month Residency Visa

If approved, you’ll receive a 4-month residency visa that allows you to enter Portugal and apply for your residence permit. The processing time for this visa ranges from 60-90 days, sometimes longer depending on the consulate.

Step 6: Travel to Portugal

Within the visa validity period, travel to Portugal to continue the business establishment process and apply for your residence permit.

Step 7: Apply for Your Residence Permit

After arriving in Portugal:

- Schedule an appointment with AIMA (formerly SEF)

- Submit additional documentation as required

- Provide biometric data (fingerprints and photo)

- Pay the residence permit fee (approximately €170)

After AIMA processes your application, you’ll receive your residence card, which is typically valid for two years.

Step 8: Establish and Operate Your Business

Once in Portugal with your initial residence permit:

- Complete company registration (if not done previously)

- Open business premises

- Register with tax authorities and social security

- Obtain necessary licenses and permits

- Begin business operations

Timeline and Costs

Typical Timeline

- Business planning and preparation: 1-3 months

- Document preparation: 1-2 months

- Visa application processing: 60-90 days

- Initial 4-month stay in Portugal

- Residence permit processing: 3-12 weeks

- Total time from planning to residence card: 6-12 months

Approximate Costs

Government Fees

- Visa application fee: €90

- Residence permit application: €170

- Residence permit issuance: €156

- Company registration fees: €360-€500

- Business license fees: Varies by activity and location

Professional Services

- Legal assistance: €1,500-€3,000

- Accounting setup: €500-€1,000

- Document translation and apostille: €300-€800

- Business plan preparation (if outsourced): €500-€2,000

- NIF and fiscal representation: €200-€500 annually

Business Setup

- Initial capital investment: Varies by business type

- Office/premises deposit and rent: Typically 2-3 months’ rent as deposit

- Equipment and supplies: Business-dependent

- Insurance: €500-€1,500 annually

Renewal and Maintaining Residency

The initial residence permit is valid for two years. To maintain and renew your D2 residency:

- Active Business Operation: Maintain active business operations in Portugal

- Tax Compliance: Ensure all business and personal tax filings are up to date

- Social Security Contributions: Make required social security payments

- Physical Presence: Spend sufficient time in Portugal (minimum 183 days per year recommended)

- Business Viability: Demonstrate the ongoing viability of your business

The renewal process involves:

- Scheduling an appointment with AIMA

- Providing updated documentation of your business activities

- Demonstrating tax compliance

- Showing evidence of sufficient income/profits

- Paying the renewal fee

After the first renewal, subsequent permits are valid for three years.

Path to Permanent Residency and Citizenship

Permanent Residency

After five years of temporary residency, you can apply for permanent residence in Portugal. Requirements include:

- Continuous legal residency for five years

- Stable income source

- Accommodation in Portugal

- Clean criminal record

- Basic knowledge of Portuguese (A2 level)

Portuguese Citizenship

You can also apply for Portuguese citizenship after five years of legal residency. The requirements include:

- Five years of legal residency

- Clean criminal record

- Sufficient knowledge of Portuguese language (A2 level)

- Effective links to the national community

A significant recent development is that the five-year countdown for citizenship eligibility now starts from the moment of applying for your residence permit, rather than from when the permit is actually granted.

Tax Considerations for Entrepreneurs

Corporate Taxation

- Corporate Income Tax (IRC): Base rate of 21% as of 2025

- Reduced Rate for SMEs: 17% on the first €50,000 of taxable profit

- Autonomous Taxation: Additional taxation on certain expenses (company cars, entertainment, etc.)

- VAT (IVA): Standard rate of 23%, intermediate rate of 13%, and reduced rate of 6%

Personal Taxation

- Personal Income Tax (IRS): Progressive rates ranging from 14.5% to 48% as of 2025

- Social Security Contributions:

- Employers: Approximately 23.75% of employee salaries

- Employees: 11% of salary

- Self-employed: Approximately 21.4% of declared income

Non-Habitual Resident (NHR) Tax Regime

Entrepreneurs and business owners may benefit from Portugal’s NHR program, which offers:

- 20% flat tax rate on income from high value-added activities in Portugal

- Potential exemption from Portuguese taxation on certain foreign-source income

- Valid for a period of 10 years

To qualify, you must:

- Not have been a Portuguese tax resident in the five years prior to application

- Register as an NHR with the Portuguese tax authorities

Business Support and Incentives

Portugal offers various support mechanisms for entrepreneurs and businesses:

Funding Programs

- Portugal 2030: EU Structural Funds program supporting business development

- Startup Portugal: Government initiative supporting the startup ecosystem

- Portugal Ventures: Venture capital investments in technology, life sciences, and tourism

- Business Innovation: Grants for innovative business projects

- IAPMEI Programs: Support from the Agency for Competitiveness and Innovation

Tax Incentives

- SIFIDE II: Tax credits for R&D activities (up to 82.5% of expenses)

- Patent Box Regime: Reduced taxation on income from patents and intellectual property

- Job Creation Incentives: Tax benefits for creating new jobs

- Regional Incentives: Enhanced benefits for businesses in lower-density regions

Business Hubs and Incubators

- Startup Lisboa: Prominent incubator in Lisbon’s city center

- UPTEC: Porto’s Science and Technology Park

- Fábrica de Startups: Startup factory with accelerator programs

- Labs Lisboa: Municipal incubator in Lisbon

- Startup Braga: Incubator and accelerator in northern Portugal

Differences Between D2 Visa and Startup Visa

While both target entrepreneurs, there are important distinctions:

| Feature | D2 Entrepreneur Visa | Startup Visa |

|---|---|---|

| Focus | Any type of business | Innovative, tech-oriented startups |

| Approval Process | Standard visa application | Requires certification by a recognized incubator |

| Evaluation | Based on viability and economic relevance | Based on innovation, scalability, and global potential |

| Target Audience | Established entrepreneurs, freelancers, small business owners | Startup founders with innovative business models |

| Processing Time | Typically 2-3 months for visa | May be faster due to dedicated program |

Practical Tips for Success

Business Plan Development

- Focus on Portugal-specific opportunities: Demonstrate knowledge of local market

- Highlight job creation potential: Show how your business will benefit the local economy

- Be realistic with financial projections: Overly optimistic projections may raise red flags

- Emphasize your expertise: Clearly connect your skills and experience to the business concept

- Include contingency plans: Show awareness of potential challenges and how you’ll address them

Business Operations

- Network locally: Join business associations and entrepreneur groups

- Hire a local accountant: Portuguese accounting rules can be complex

- Consider location carefully: Business costs vary significantly across regions

- Start language learning early: While many Portuguese speak English, knowing Portuguese is invaluable

- Understand cultural differences: Business practices may differ from your home country

Common Pitfalls to Avoid

- Insufficient business documentation: Provide comprehensive business plans and financial projections

- Underestimating startup costs: Budget for unexpected expenses and delays

- Neglecting tax obligations: Ensure compliance with all tax filing requirements

- Visa-business mismatch: Ensure your actual business activities match what was described in your visa application

- Isolation from the business community: Actively network and integrate into local business ecosystems

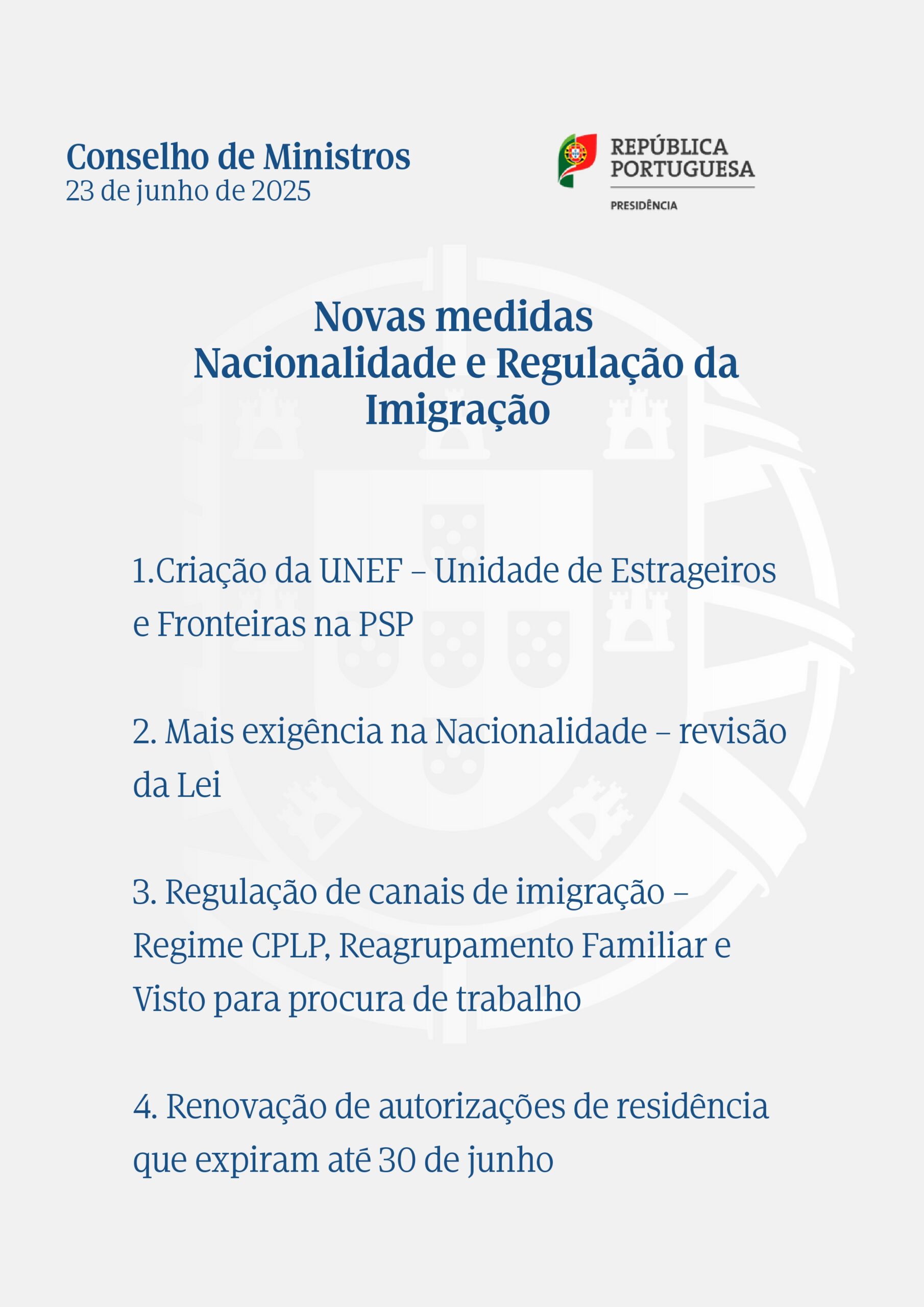

Special Considerations for 2025

AIMA Processing Improvements

AIMA (formerly SEF) has implemented several improvements to streamline visa processing in 2025:

- Enhanced online application platform

- Additional processing centers

- Increased staffing to address backlogs

- Extension of document validity periods until June 30, 2025

Digital Transformation

Portugal’s push for digital transformation has created opportunities for entrepreneurs in:

- E-commerce and digital services

- Remote work solutions

- Fintech and digital banking

- AI and machine learning applications

- Sustainable technology solutions

Post-Pandemic Business Landscape

The post-pandemic business environment in Portugal has evolved:

- Increased acceptance of digital business models

- Growing remote workforce availability

- Emerging market needs in health tech, remote services, and sustainable solutions

- Enhanced digital infrastructure throughout the country

Regional Business Opportunities

Portugal offers diverse regional business opportunities:

Lisbon Region

- Tech and Startups: Thriving tech ecosystem with numerous incubators and accelerators

- Tourism and Hospitality: Premium and boutique offerings in high demand

- Creative Industries: Design, media, and content creation hubs

Porto and Northern Portugal

- Manufacturing: Traditional and innovative manufacturing facilities

- Wine and Food: Opportunities in production, export, and gastronomic tourism

- Technology: Growing tech scene with more affordable costs than Lisbon

Algarve Region

- Tourism: Year-round tourism services beyond the traditional beach season

- Retirement Services: Catering to expat and retiree communities

- Sustainable Development: Eco-tourism and sustainable housing projects

Central Portugal and Silver Coast

- Agriculture and Food Production: Quality local products with export potential

- Remote Work Infrastructure: Services for the growing digital nomad population

- Wellness and Retreat Centers: Leveraging natural beauty and lower property costs

Madeira and Azores

- Tourism: Unique nature and adventure tourism opportunities

- Digital Nomad Services: Catering to remote workers attracted by tax incentives

- Marine Economy: Fishing, aquaculture, and ocean-related technologies

Conclusion

The Portugal D2 Entrepreneur Visa offers an excellent pathway to Portuguese residency for business-minded individuals looking to establish or relocate business activities to Portugal. With its relatively flexible requirements, absence of a specified minimum investment amount, and clear path to permanent residency and citizenship, the D2 visa provides an attractive option for entrepreneurs seeking to base themselves in Europe.

While the application process requires thorough preparation and documentation of your business concept, Portugal’s supportive business environment, growing startup ecosystem, and excellent quality of life make it worth the effort. The country’s strategic location, EU membership, and competitive tax incentives further enhance its appeal as a business destination.

By carefully planning your business venture, understanding the local market, and ensuring compliance with all legal and tax requirements, you can successfully leverage the D2 visa to build a thriving business in Portugal while enjoying all the benefits of Portuguese residency.