The Most Comprehensive Guide to Obtaining NIF (Número de Identificação Fiscal) in Portugal

What is a NIF Number?

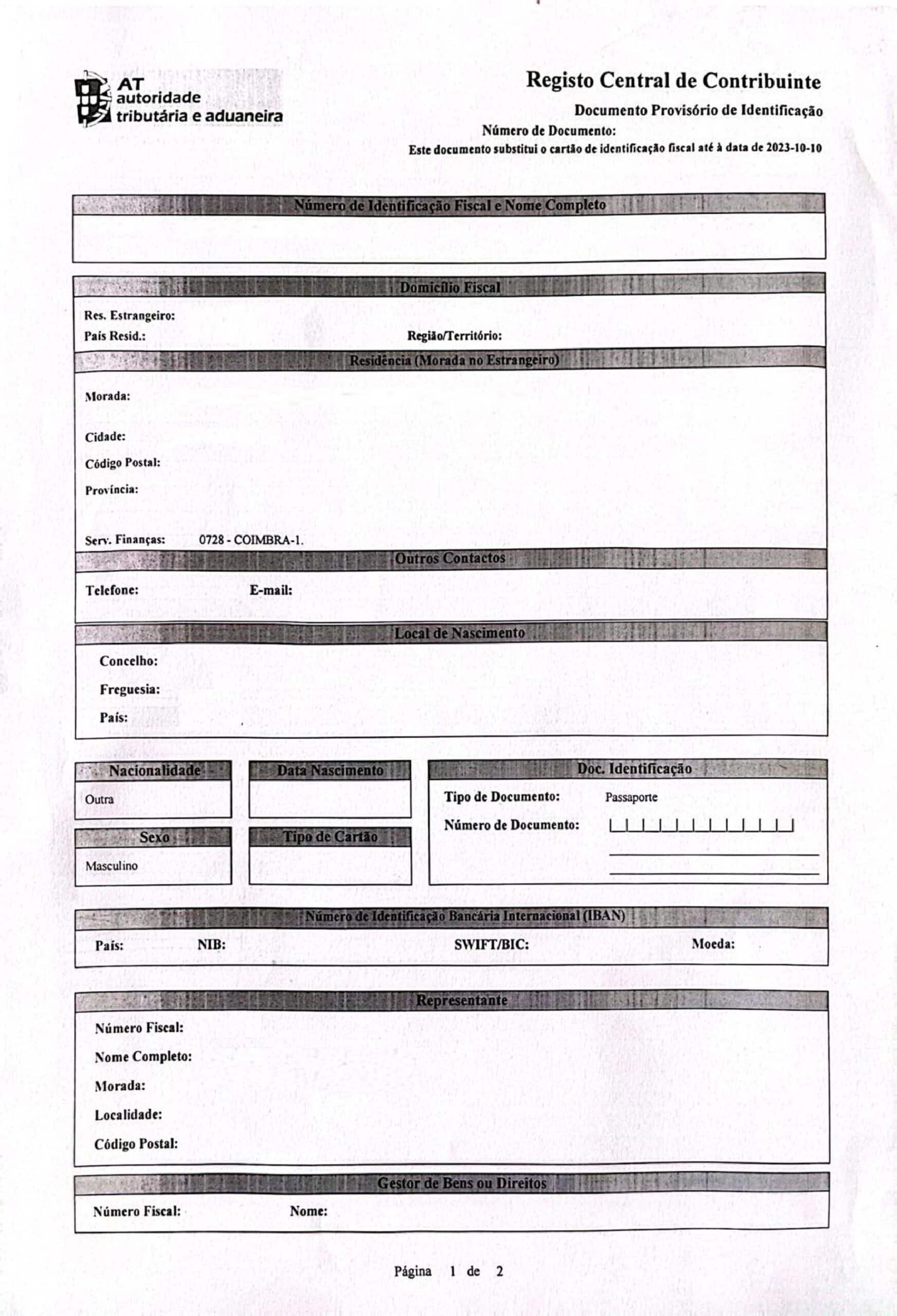

The NIF (Número de Identificação Fiscal), also known as Número de Contribuinte, is Portugal’s tax identification number. This unique 9-digit number serves as your primary identifier for all tax-related matters and numerous daily activities in Portugal.

Every person and entity in Portugal receives a unique 9-digit number that remains valid for life. Once issued, your NIF never expires and cannot be cancelled. It’s required for tax purposes, financial transactions, legal matters, and many everyday activities. The format is always 9 digits, such as 123 456 789.

It’s important to understand that NIF is different from NISS (Número de Identificação de Segurança Social), which is your Social Security number. While NIF handles all tax-related matters, NISS is specifically for social security benefits and contributions. Most people who work or live in Portugal will eventually need both numbers.

At Access Portugal, we specialize in helping international clients obtain their NIF quickly and efficiently, with full support throughout the process. Our expertise ensures that your application is handled correctly from the start, avoiding common pitfalls that can delay the process.

Who Needs a NIF in Portugal?

Mandatory Requirements

Portuguese citizens in general automatically receive their NIF when they obtain their Citizen Card. However, foreign residents must apply for one upon establishing residency in Portugal. Property owners cannot complete any transaction without a NIF, making it essential for buying, selling, or even renting property. Business owners need a NIF for any commercial activity, while employees cannot sign employment contracts without one. Students require a NIF for university enrollment, and it’s absolutely mandatory for opening bank accounts in Portugal.

Beyond these basic requirements, many other situations demand a NIF. Golden Visa applicants need one as part of their investment process. Those applying for the D7 Visa for retirement or passive income cannot proceed without a NIF. Digital nomads seeking the D8 Visa face the same requirement. Anyone pursuing Non-Habitual Resident (NHR) status must have a NIF to benefit from the special tax regime.

Additional Situations Requiring NIF

Non-residents who earn income in Portugal, whether from property rentals, investments, or remote work, must obtain a NIF for tax compliance. Inheritance beneficiaries need one to receive Portuguese assets. Anyone signing contracts in Portugal, from mobile phone plans to gym memberships, will be asked for their NIF. Even cryptocurrency traders operating in Portugal need a NIF for proper tax reporting.

Tourists generally don’t need a NIF unless they’re making significant purchases like buying a car or expensive items where tax receipts are important. Short-term visitors only need one if conducting financial transactions. Children require a NIF for school enrollment and healthcare registration, and parents need their children’s NIFs to claim tax deductions for education and health expenses.

Access Portugal helps all categories of applicants, from property investors to digital nomads, ensuring each client receives personalized service based on their specific needs. We understand that each situation is unique and provide tailored guidance accordingly.

Personal NIF: Complete Guide for Individuals

Application Methods Available

There are several ways to obtain a personal NIF in Portugal, each with distinct advantages and challenges. Understanding these options helps you choose the best path for your situation.

Through Access Portugal - The Professional Solution

Access Portugal has streamlined the NIF application process for international clients. Our service eliminates the need to visit Portugal, removes language barriers entirely, and includes professional fiscal representation for those who require it. The complete online process suits all nationalities and provides ongoing support after NIF issuance.

This approach particularly benefits non-EU citizens who face mandatory fiscal representation requirements, property buyers needing NIFs for transactions, business investors and entrepreneurs establishing Portuguese operations, digital nomads and remote workers setting up their tax affairs, retirees planning their move to Portugal, and anyone who prefers professional handling of bureaucratic processes.

In-Person at Finanças Office

EU/EEA citizens already in Portugal who speak Portuguese might consider applying directly at a Finanças office. The process involves finding your local office, preparing required documents, taking a numbered ticket, waiting your turn, submitting your application, and receiving your NIF on paper.

However, this method presents several challenges. Long queues are common, especially in major cities like Lisbon and Porto. Language barriers can make communication difficult, even for those with basic Portuguese. Limited office hours mean taking time off work, and complex cases may require multiple visits. There’s no ongoing support after you receive your NIF, leaving you to navigate future tax obligations alone.

Through Portuguese Consulates

Portuguese citizens living abroad can apply through consulates, though this option has limitations. Requirements vary significantly by location, appointments often require months of advance booking, and the service is generally limited to Portuguese nationals or specific visa applicants.

Fiscal Representatives Explained

Understanding Fiscal Representation

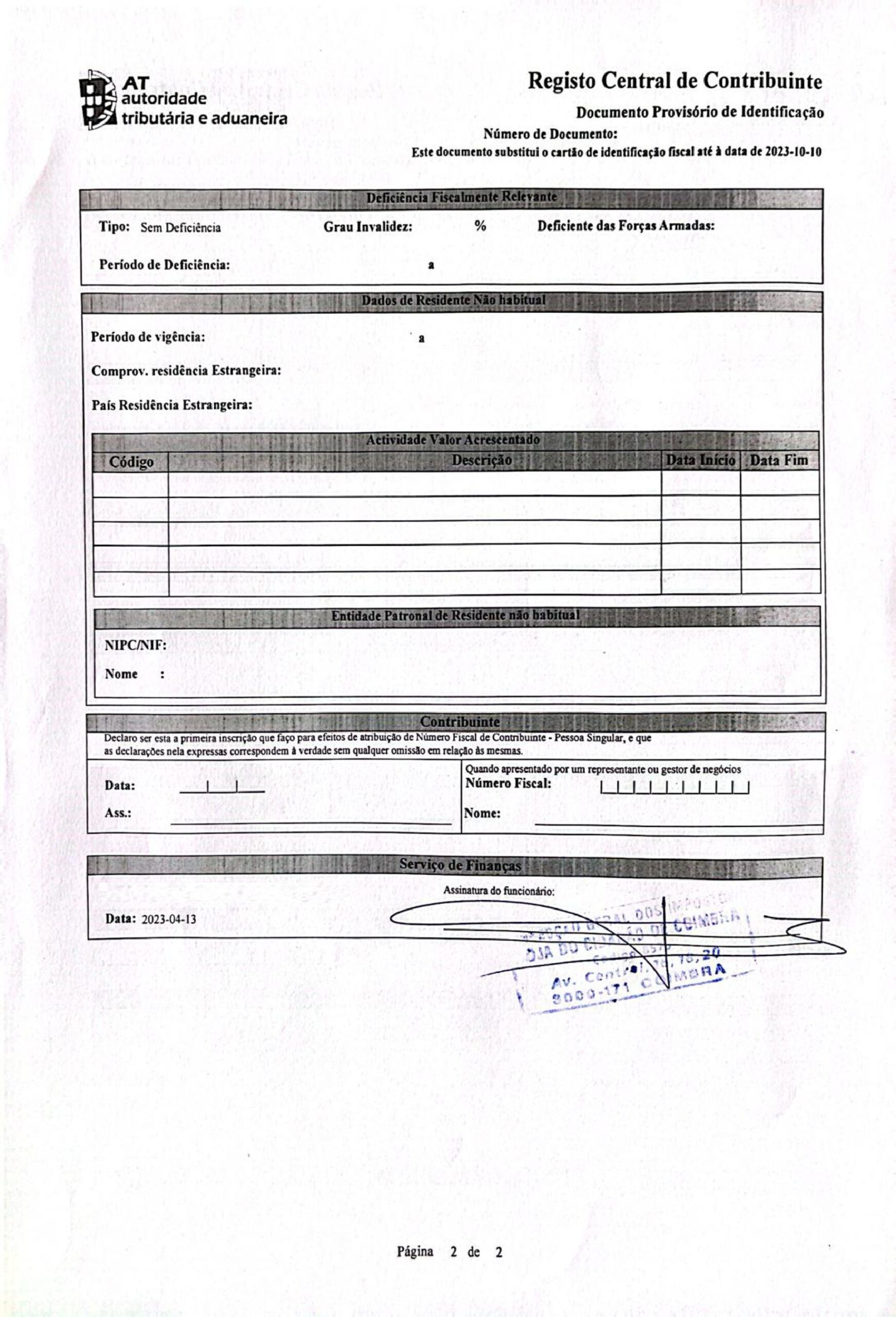

A fiscal representative serves as your official point of contact with Portuguese tax authorities when you lack a Portuguese address. This role goes beyond simple mail forwarding – it’s about ensuring compliance with Portuguese tax law and protecting your interests.

Portuguese tax law requires non-EU residents with tax obligations to maintain fiscal representation. This isn’t merely bureaucratic formality but serves important purposes. Tax authorities need a reliable point of contact within Portugal for official communications. Time-sensitive tax matters often require responses within 10-15 days, making local representation crucial.

Access Portugal as Your Fiscal Representative

When choosing Access Portugal as your fiscal representative, you gain a professional partner in Portuguese tax compliance. Our comprehensive service begins with providing an official Portuguese address for all tax correspondence. Every piece of mail receives careful attention, with important documents scanned and forwarded promptly with clear explanations in your language.

We monitor critical deadlines religiously, ensuring you never miss important tax obligations. When matters require urgent attention, our team responds professionally on your behalf within required timeframes. All correspondence arrives digitally for your convenience, with translations and explanations ensuring you understand every communication.

Beyond basic representation, Access Portugal provides valuable additional services. We send proactive tax calendar reminders for important deadlines. Our compliance monitoring helps ensure you maintain good standing with Portuguese authorities. Direct communication with Finanças eliminates language barriers and bureaucratic confusion. When problems arise, our experienced team handles resolution efficiently. Annual renewals process seamlessly, maintaining continuous representation without gaps.

The Professional Difference

Choosing professional representation over informal arrangements with friends or acquaintances provides crucial advantages. Legal compliance comes from deep understanding of Portuguese tax law – something casual representatives rarely possess. Reliability means never worrying about missed deadlines due to vacations or personal issues. Professional liability insurance protects your interests. Language support ensures nothing gets lost in translation. Most importantly, ongoing availability means help is always there when you need it.

Recent Regulatory Changes

The 2022 update to fiscal representation rules created new flexibility for some taxpayers. While regulations now allow certain alternatives to traditional fiscal representation, Access Portugal continues recommending professional representation for most international clients. Proper management of tax correspondence remains crucial. Meeting tax obligations on time requires vigilance and expertise. Language barriers can create serious problems when dealing with technical tax matters. Professional support provides peace of mind that amateur arrangements simply cannot match.